Introduction:

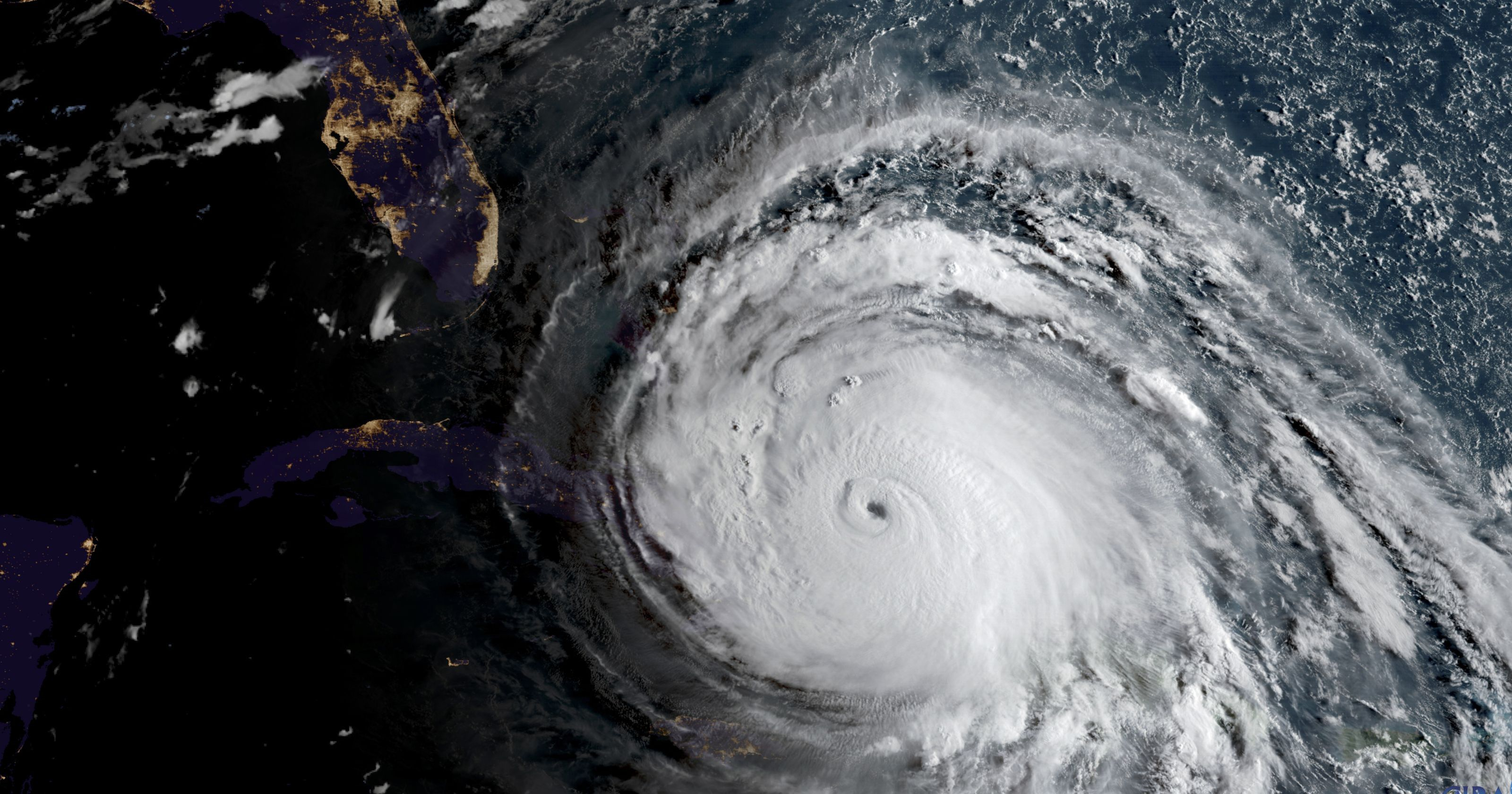

Property insurance is a vital safeguard against the financial risks associated with damage or loss to real estate, buildings, or personal belongings. When delving into the intricacies of property insurance policies, one crucial aspect that policyholders should understand is the suit condition. This provision serves as an important clause in insurance contracts, influencing the policyholder’s responsibilities in the event of a claim. In this blog, we will explore what the suit condition means, its significance, and its impact on property insurance coverage.

Understanding the Suit Condition:

The suit condition, also known as the “suits against insurers” provision, is a clause found in property insurance policies. It outlines the actions and obligations that the policyholder must adhere to when filing a claim against the insurance company. Simply put, the suit condition sets forth the specific procedures and limitations within which the policyholder must act to seek compensation for covered losses.

Key Elements of the Suit Condition:

1. Notice Requirement: The suit condition typically mandates that the policyholder must notify the insurance company promptly after an incident occurs or damages are discovered. This notification should include essential details such as the date, time, location, and nature of the loss or damage. Failing to provide timely notice may result in denial of the claim.

2. Cooperation: Policyholders are obligated to cooperate fully with the insurance company during the claims process. This cooperation entails providing necessary documents, evidence, and any requested information related to the loss or damage. Failure to cooperate may jeopardize the claim and potentially result in the denial of coverage.

3. Legal Action Timeframe: The suit condition specifies a time limit within which the policyholder must initiate legal action against the insurance company if a dispute arises regarding the claim. This time limit, often referred to as the statute of limitations, can vary depending on the policy and jurisdiction. It is crucial for policyholders to be aware of and adhere to this timeframe to preserve their rights.

Significance of the Suit Condition:

The suit condition serves multiple purposes within a property insurance policy:

1. Protecting the Insurer: The suit condition helps safeguard insurance companies from fraudulent or exaggerated claims by imposing specific requirements on policyholders. By establishing a set of obligations, insurers can ensure that claims are thoroughly investigated and that they are not unduly burdened with unnecessary or invalid requests.

2. Encouraging Timely Reporting: Prompt notice of a loss is crucial for insurers to promptly assess damages, initiate repairs, or conduct investigations. The suit condition promotes timely reporting, ensuring that the insurance company can effectively fulfill its obligations and mitigate further losses.

3. Resolving Disputes Efficiently: In the event of a claim dispute, the suit condition sets clear guidelines and time limits for policyholders to initiate legal action. This provision helps encourage timely resolution of conflicts and prevents unnecessary delays or prolonged litigation.

Conclusion:

Understanding the suit condition is essential for policyholders seeking coverage under a property insurance policy. By comprehending the obligations and requirements outlined in this provision, policyholders can navigate the claims process more effectively. Adhering to the suit condition ensures that policyholders fulfill their responsibilities, enhancing the chances of a successful claim settlement. Remember to carefully review your policy and consult with your insurance provider or a professional if you have any doubts or questions regarding the suit condition or any other aspect of your property insurance coverage. We will help, find out more at aaapublicadjusters.com.

Our highly trained, licensed public adjusters will guide you through the process of preparing and filing an insurance claim in a professional manner. Similar to hiring an attorney if you needed to go to court, or hire a certified public accountant to file your tax return, you should only file an insurance claim with your own professional insurance and construction expert – at aaapublicadjusters.com.

Let aaapublicadjusters.com get you the maximum return on your insurance claim! See how we can help.

To start a new claim, call 1.800.410.5054 today for a free inspection and policy examination from our Public Adjusters.